Indicator Improvement- Part 1- A supervised classification learning

As a trader, I do not need to predict the final price to be able to make a profit! As far as I could distinguish a trend in the price change, I can enter a trade and make a profit. This is the mindset of the majority of the scalpers and the day traders! Over a years, lots of methods and trading strategies have been developed for this aim. In the trading world, people are looking to the indicators to get trading pulses! For example, when a 20-bar simple moving average (SMA) passes and goes above the 50-bar SMA, that indicates an up trend in the price, so people get a long trade. Unfortunately, these indicators do not work well, and the nature of the market can be much more complicated. Here, I want to see if a supervised ML algorithm can help us to improve this indicator!

What I am going to do here is not a regression, but classification! I need to know whether the indicator can show the up or down trends or not! Therefore, I need to alter the time series data frame to satisfy this purpose. Let’s start with importing libraries and data.

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

from sklearn.compose import ColumnTransformer, make_column_transformer

from sklearn.dummy import DummyClassifier

from sklearn.ensemble import RandomForestClassifier

from sklearn.impute import SimpleImputer

from sklearn.linear_model import LogisticRegression

from sklearn.model_selection import (

TimeSeriesSplit,

cross_val_score,

cross_validate,

train_test_split,

)

from sklearn.pipeline import Pipeline, make_pipeline

from sklearn.preprocessing import OneHotEncoder, OrdinalEncoder, StandardScaler

plt.rcParams["font.size"] = 16

from datetime import datetime

from google.colab import drive

drive.mount('/content/gdrive')

Drive already mounted at /content/gdrive; to attempt to forcibly remount, call drive.mount("/content/gdrive", force_remount=True).

fx_df = pd.read_csv('/content/gdrive/MyDrive/Python-Colab-Projects/Forex_Data/EURGBP_Candlestick_5_M_BID_14.10.2019-14.10.2022.csv')

fx_df.head()

| Gmt time | Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|---|

| 0 | 15.10.2019 00:00:00.000 | 0.87438 | 0.87461 | 0.87429 | 0.87430 | 434.60 |

| 1 | 15.10.2019 00:05:00.000 | 0.87430 | 0.87440 | 0.87418 | 0.87440 | 402.75 |

| 2 | 15.10.2019 00:10:00.000 | 0.87441 | 0.87450 | 0.87439 | 0.87448 | 421.10 |

| 3 | 15.10.2019 00:15:00.000 | 0.87448 | 0.87451 | 0.87436 | 0.87441 | 342.43 |

| 4 | 15.10.2019 00:20:00.000 | 0.87441 | 0.87444 | 0.87435 | 0.87443 | 195.58 |

When the market is closed, the prices are set on the last price of the active market. However, I can find those times by looking at the volume of the trades and dropping them.

fx_df.loc[fx_df['Volume'] == 0].head()

| Gmt time | Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|---|

| 1116 | 18.10.2019 21:00:00.000 | 0.86047 | 0.86047 | 0.86047 | 0.86047 | 0.0 |

| 1117 | 18.10.2019 21:05:00.000 | 0.86047 | 0.86047 | 0.86047 | 0.86047 | 0.0 |

| 1118 | 18.10.2019 21:10:00.000 | 0.86047 | 0.86047 | 0.86047 | 0.86047 | 0.0 |

| 1119 | 18.10.2019 21:15:00.000 | 0.86047 | 0.86047 | 0.86047 | 0.86047 | 0.0 |

| 1120 | 18.10.2019 21:20:00.000 | 0.86047 | 0.86047 | 0.86047 | 0.86047 | 0.0 |

fx_df_active = fx_df.loc[fx_df['Volume'] != 0]

fx_df_active.loc[fx_df_active['Volume'] == 0].any()

Gmt time False

Open False

High False

Low False

Close False

Volume False

dtype: bool

Checking for missing data:

fx_df_active.isnull().any()

Gmt time False

Open False

High False

Low False

Close False

Volume False

dtype: bool

Now, convert the index to the date-time. Also, I want to remove the volume column and go just with the time and price analysis.

fx_df_active.columns = ['date', 'open', 'high', 'low', 'close', 'volume']

fx_df_active.loc[:, 'date'] = pd.to_datetime(fx_df_active.loc[:, 'date'] , format='%d.%m.%Y %H:%M:%S.%f')

fx_df_active = fx_df_active.set_index(fx_df_active.loc[:, 'date'])

fx_df_5m = fx_df_active[['open', 'high', 'low', 'close', 'volume']]

fx_df_5m = fx_df_5m.drop_duplicates(keep=False)

/usr/local/lib/python3.7/dist-packages/pandas/core/indexing.py:1773: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame.

Try using .loc[row_indexer,col_indexer] = value instead

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

self._setitem_single_column(ilocs[0], value, pi)

fx_df_5m_prices = fx_df_5m.drop(['volume'], axis=1) #dropping volume column

fx_df_5m_prices.head()

| open | high | low | close | |

|---|---|---|---|---|

| date | ||||

| 2019-10-15 00:00:00 | 0.87438 | 0.87461 | 0.87429 | 0.87430 |

| 2019-10-15 00:05:00 | 0.87430 | 0.87440 | 0.87418 | 0.87440 |

| 2019-10-15 00:10:00 | 0.87441 | 0.87450 | 0.87439 | 0.87448 |

| 2019-10-15 00:15:00 | 0.87448 | 0.87451 | 0.87436 | 0.87441 |

| 2019-10-15 00:20:00 | 0.87441 | 0.87444 | 0.87435 | 0.87443 |

Similar to the previous work, I am adding the lagged data and the simple moving averages to the data frame.

fx_lag_prices_df = fx_df_5m_prices.copy()

for i in range(1,7):

forex_data_lag = fx_df_5m_prices.shift(i)

lag_columns = list( s+"_lag%d" % i for s in fx_df_5m_prices.columns)

forex_data_lag.columns = lag_columns

fx_lag_prices_df = pd.concat([fx_lag_prices_df, forex_data_lag], axis =1)

def simple_moving_average(data, moving_average_list, criteria='close'):

df = pd.DataFrame()

for ma in moving_average_list:

sma_column = f"sma{ma}"

sma = data[criteria].rolling(center=False, window = ma).mean().to_frame(name = sma_column)

df = pd.concat((df, sma), axis=1)

return(df )

sma_df = simple_moving_average(fx_df_5m_prices, [20, 50, 100])

fx_lag_prices_sma_df = pd.concat([fx_lag_prices_df, sma_df], axis =1)

fx_lag_prices_sma_df.head()

| open | high | low | close | open_lag1 | high_lag1 | low_lag1 | close_lag1 | open_lag2 | high_lag2 | ... | high_lag5 | low_lag5 | close_lag5 | open_lag6 | high_lag6 | low_lag6 | close_lag6 | sma20 | sma50 | sma100 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | |||||||||||||||||||||

| 2019-10-15 00:00:00 | 0.87438 | 0.87461 | 0.87429 | 0.87430 | NaN | NaN | NaN | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2019-10-15 00:05:00 | 0.87430 | 0.87440 | 0.87418 | 0.87440 | 0.87438 | 0.87461 | 0.87429 | 0.87430 | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2019-10-15 00:10:00 | 0.87441 | 0.87450 | 0.87439 | 0.87448 | 0.87430 | 0.87440 | 0.87418 | 0.87440 | 0.87438 | 0.87461 | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2019-10-15 00:15:00 | 0.87448 | 0.87451 | 0.87436 | 0.87441 | 0.87441 | 0.87450 | 0.87439 | 0.87448 | 0.87430 | 0.87440 | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2019-10-15 00:20:00 | 0.87441 | 0.87444 | 0.87435 | 0.87443 | 0.87448 | 0.87451 | 0.87436 | 0.87441 | 0.87441 | 0.87450 | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

5 rows × 31 columns

The forex market is indeed a 24-hour market, but it does not mean that it is always active! The active hours of the forex market are in tune with the active hours of other markets in Europe and the USA. So, it is good the add the trading hours as a feature to our data frame.

fx_df_5m.index.hour.unique().values

array([ 0, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16,

17, 18, 19, 20, 21, 22, 23])

fx_lag_prices_sma_hour_df = fx_lag_prices_sma_df.copy()

fx_lag_prices_sma_hour_df['trade_hour'] = fx_lag_prices_sma_hour_df.index.hour

Another feature I am going to add to the data frame is the differences between the current closing price with the maximum/minimum of the price in the past data points. Each data point (bar, as it is called) in our 5-min chart shows opening and closing prices as well as the maximum and minimum of the price in a 5-minute interval.

fx_lag_prices_sma_hour_minmax_df = fx_lag_prices_sma_hour_df.copy()

n_minmax = 12 #number of the past data points

clmn_min = f'dis_to_min_{n_minmax}bar'

clmn_max = f'dis_to_max_{n_minmax}bar'

fx_lag_prices_sma_hour_minmax_df[clmn_max] = 0

fx_lag_prices_sma_hour_minmax_df[clmn_min] = 0

for i in range(0,len(fx_lag_prices_sma_hour_df)):

if i < n_minmax:

dis_to_max = fx_lag_prices_sma_hour_minmax_df['close'].iloc[0:i+1].max() - fx_lag_prices_sma_hour_minmax_df['close'].iloc[i]

fx_lag_prices_sma_hour_minmax_df[clmn_max].iloc[i] = dis_to_max

dis_to_min = fx_lag_prices_sma_hour_minmax_df['close'].iloc[i] - fx_lag_prices_sma_hour_minmax_df['close'].iloc[0:i+1].min()

fx_lag_prices_sma_hour_minmax_df[clmn_min].iloc[i] = dis_to_min

else:

dis_to_max = fx_lag_prices_sma_hour_minmax_df['close'].iloc[i-n_minmax:i+1].max() - fx_lag_prices_sma_hour_minmax_df['close'].iloc[i]

fx_lag_prices_sma_hour_minmax_df[clmn_max].iloc[i] = dis_to_max

dis_to_min = fx_lag_prices_sma_hour_minmax_df['close'].iloc[i] - fx_lag_prices_sma_hour_minmax_df['close'].iloc[i-n_minmax:i+1].min()

fx_lag_prices_sma_hour_minmax_df[clmn_min].iloc[i] = dis_to_min

Usually, I copied the last feature-engineered data frame, to a new one. In this way, by changing the features, it is easier to update the rest of the program and models.

exd_df_final = fx_lag_prices_sma_hour_minmax_df.dropna()

exd_df_final.head()

| open | high | low | close | open_lag1 | high_lag1 | low_lag1 | close_lag1 | open_lag2 | high_lag2 | ... | open_lag6 | high_lag6 | low_lag6 | close_lag6 | sma20 | sma50 | sma100 | trade_hour | dis_to_max_12bar | dis_to_min_12bar | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | |||||||||||||||||||||

| 2019-10-15 08:15:00 | 0.87099 | 0.87114 | 0.87055 | 0.87104 | 0.87096 | 0.87122 | 0.87073 | 0.87098 | 0.87068 | 0.87165 | ... | 0.87022 | 0.87082 | 0.87017 | 0.87048 | 0.871091 | 0.872396 | 0.873362 | 8 | 0.00052 | 0.00099 |

| 2019-10-15 08:20:00 | 0.87107 | 0.87187 | 0.87092 | 0.87179 | 0.87099 | 0.87114 | 0.87055 | 0.87104 | 0.87096 | 0.87122 | ... | 0.87048 | 0.87127 | 0.87027 | 0.87091 | 0.871109 | 0.872345 | 0.873337 | 8 | 0.00000 | 0.00174 |

| 2019-10-15 08:25:00 | 0.87179 | 0.87179 | 0.87044 | 0.87080 | 0.87107 | 0.87187 | 0.87092 | 0.87179 | 0.87099 | 0.87114 | ... | 0.87091 | 0.87156 | 0.87080 | 0.87156 | 0.871094 | 0.872275 | 0.873301 | 8 | 0.00099 | 0.00075 |

| 2019-10-15 08:30:00 | 0.87080 | 0.87116 | 0.87013 | 0.87045 | 0.87179 | 0.87179 | 0.87044 | 0.87080 | 0.87107 | 0.87187 | ... | 0.87155 | 0.87161 | 0.87056 | 0.87069 | 0.871031 | 0.872200 | 0.873260 | 8 | 0.00134 | 0.00024 |

| 2019-10-15 08:35:00 | 0.87045 | 0.87062 | 0.87008 | 0.87062 | 0.87080 | 0.87116 | 0.87013 | 0.87045 | 0.87179 | 0.87179 | ... | 0.87068 | 0.87165 | 0.87054 | 0.87097 | 0.870946 | 0.872130 | 0.873223 | 8 | 0.00117 | 0.00041 |

5 rows × 34 columns

Now, the most important part is: what is the target?

As I explained at the beginning, I expect an up trend if 20-bar SMA goes above 50-bar SMA, and a downtrend if it goes in the opposite way. But, the reality might be different from my expectation. So, let’s look at the behavior of the close price, during 10 data points after 20-bar SMA passes the 50-Bar SMA.

So, the new data frame only includes the data of the passing points. The target is the behavior of the close price and its difference from our expectations. For example, if we expect an up trend, but in the next 10 data points, the minimum price moves downwards by 0.0010 (10 pips), I classified this data point as “UpTrend-PriceDown”. Here, the first part (UpTrend) shows my expectation from the indicator, and the second part (PriceDown) shows the actual behavior of the price in 10 data points in the future. Other defined classes are distinguished in the comments.

pred_windo = 10

pip_val = 0.0010 #10 pips

df_size = len(exd_df_final)

ctgorized_df_columns = list(list(exd_df_final.columns) + ['market-type'] )

ctgorized_df = pd.DataFrame(columns = ctgorized_df_columns)

_row_series = []

for i in range(1, df_size - pred_windo):

#for i in range(1, 1000):

if exd_df_final['sma20'][i-1] <= exd_df_final['sma50'][i-1]:

if exd_df_final['sma20'][i] > exd_df_final['sma50'][i]: #Expecting a Bull market

if exd_df_final['close'][i:i+pred_windo].max() - exd_df_final['close'][i] > pip_val:

if exd_df_final['close'][i] - exd_df_final['close'][i:i+pred_windo].min() < pip_val:

mkt = 'UpTrend_PriceUp' #Expecting an up trend, the price goes up

if exd_df_final['close'][i:i+pred_windo].max() - exd_df_final['close'][i] < pip_val:

if exd_df_final['close'][i] - exd_df_final['close'][i:i+pred_windo].min() > pip_val:

mkt = 'UpTrend-PriceDown' #Expecting an up trend, the price goes down

if exd_df_final['close'][i:i+pred_windo].max() - exd_df_final['close'][i] > pip_val:

if exd_df_final['close'][i] - exd_df_final['close'][i:i+pred_windo].min() > pip_val:

mkt = 'UpTrend-Volatile' #Expecting an up trend, the price moves in both ways

if exd_df_final['close'][i:i+pred_windo].max() - exd_df_final['close'][i] < pip_val:

if exd_df_final['close'][i] - exd_df_final['close'][i:i+pred_windo].min() < pip_val:

mkt = 'UpTrend-NoTrend' #Expecting an up trend, the price does not change by 10 pips

_row_series = pd.Series(exd_df_final.iloc[i,:])

_row_series = list(list(_row_series) + [mkt])

ctgorized_df = ctgorized_df.append(pd.Series(_row_series,

index = ctgorized_df_columns),

ignore_index = True, sort = False)

if exd_df_final['sma20'][i-1] >= exd_df_final['sma50'][i-1]:

if exd_df_final['sma20'][i] < exd_df_final['sma50'][i]: #Expecting a Bear market

if exd_df_final['close'][i:i+pred_windo].max() - exd_df_final['close'][i] < pip_val:

if exd_df_final['close'][i] - exd_df_final['close'][i:i+pred_windo].min() > pip_val:

mkt = 'DownTrend-PriceDown' #Expecting a down trend, the price goes down

if exd_df_final['close'][i:i+pred_windo].max() - exd_df_final['close'][i] > pip_val:

if exd_df_final['close'][i] - exd_df_final['close'][i:i+pred_windo].min() < pip_val:

mkt = 'DownTrend-PriceUp' #Expecting a down trend, the price goes up

if exd_df_final['close'][i:i+pred_windo].max() - exd_df_final['close'][i] > pip_val:

if exd_df_final['close'][i] - exd_df_final['close'][i:i+pred_windo].min() > pip_val:

mkt = 'DownTrend-Volatile' #Expecting a down trend, the price moves in both ways

if exd_df_final['close'][i:i+pred_windo].max() - exd_df_final['close'][i] < pip_val:

if exd_df_final['close'][i] - exd_df_final['close'][i:i+pred_windo].min() < pip_val:

mkt = 'DownTrend-NoTrend' #Expecting a down trend, the price does not change by 10 pips

_row_series = pd.Series(exd_df_final.iloc[i,:])

_row_series = list(list(_row_series) + [mkt])

ctgorized_df = ctgorized_df.append(pd.Series(_row_series,

index = ctgorized_df_columns),

ignore_index = True, sort = False)

ctgorized_df.head()

| open | high | low | close | open_lag1 | high_lag1 | low_lag1 | close_lag1 | open_lag2 | high_lag2 | ... | high_lag6 | low_lag6 | close_lag6 | sma20 | sma50 | sma100 | trade_hour | dis_to_max_12bar | dis_to_min_12bar | market-type | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.87138 | 0.87138 | 0.87064 | 0.87103 | 0.87093 | 0.87156 | 0.87056 | 0.87139 | 0.87088 | 0.87134 | ... | 0.87217 | 0.87121 | 0.87161 | 0.871588 | 0.871522 | 0.872727 | 10.0 | 0.00291 | 0.00015 | UpTrend-PriceDown |

| 1 | 0.86942 | 0.87013 | 0.86900 | 0.87012 | 0.86939 | 0.86976 | 0.86913 | 0.86943 | 0.86988 | 0.87028 | ... | 0.87070 | 0.87012 | 0.87050 | 0.871093 | 0.871101 | 0.872387 | 10.0 | 0.00127 | 0.00076 | DownTrend-PriceUp |

| 2 | 0.86411 | 0.86417 | 0.86403 | 0.86409 | 0.86409 | 0.86416 | 0.86407 | 0.86409 | 0.86395 | 0.86412 | ... | 0.86400 | 0.86353 | 0.86389 | 0.863412 | 0.863401 | 0.864325 | 22.0 | 0.00042 | 0.00121 | UpTrend-NoTrend |

| 3 | 0.86455 | 0.86470 | 0.86453 | 0.86469 | 0.86441 | 0.86456 | 0.86422 | 0.86456 | 0.86467 | 0.86468 | ... | 0.86483 | 0.86466 | 0.86471 | 0.864797 | 0.864814 | 0.864159 | 2.0 | 0.00019 | 0.00028 | DownTrend-NoTrend |

| 4 | 0.86504 | 0.86504 | 0.86430 | 0.86468 | 0.86527 | 0.86536 | 0.86500 | 0.86502 | 0.86504 | 0.86530 | ... | 0.86484 | 0.86461 | 0.86479 | 0.864798 | 0.864798 | 0.864729 | 6.0 | 0.00065 | 0.00015 | UpTrend_PriceUp |

5 rows × 35 columns

ctgorized_df['market-type'].value_counts()

DownTrend-NoTrend 2255

UpTrend-NoTrend 2237

UpTrend_PriceUp 238

DownTrend-PriceUp 228

UpTrend-PriceDown 218

DownTrend-PriceDown 208

DownTrend-Volatile 12

UpTrend-Volatile 8

Name: market-type, dtype: int64

As can be seen, the defined classes are very imbalanced. The last two classes rarely happen, so, I’ll start by dropping them. Later, I’ll deal with imbalances in a separate blog post, but for now, let’s see how much a classification ML algorithm is successful to classify this problem.

ctgorized_df.drop(ctgorized_df[ctgorized_df['market-type']=='DownTrend-Volatile'].index, inplace=True)

ctgorized_df.drop(ctgorized_df[ctgorized_df['market-type']=='UpTrend-Volatile'].index, inplace=True)

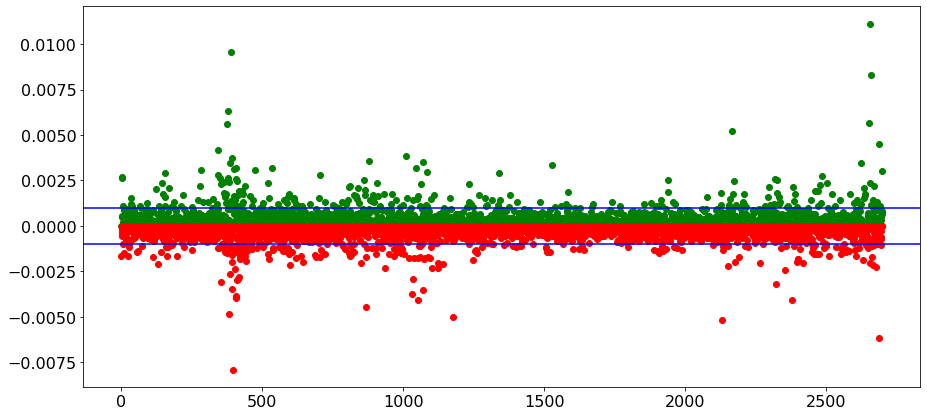

Besides the imbalanced classes, we can understand that the indicator we are looking at, is not a good indicator to show the trend. Let me show the graph of the price changes when we expect to have an up trend!

df_size = len(exd_df_final)

up_up_series = []

up_down_series = []

for i in range(1, df_size - pred_windo):

if exd_df_final['sma20'][i-1] <= exd_df_final['sma50'][i-1]:

if exd_df_final['sma20'][i] > exd_df_final['sma50'][i]: #Bull market

bull_max_dif = exd_df_final['close'][i:i+pred_windo].max() - exd_df_final['close'][i]

up_up_series.append(bull_max_dif)

bull_min_dif = exd_df_final['close'][i] - exd_df_final['close'][i:i+pred_windo].min()

up_down_series.append(-1*bull_min_dif)

plt.figure()

plt.rcParams["figure.figsize"] = (15,7)

plt.scatter(range(len(up_up_series)),up_up_series, marker='o', c='g')

plt.axhline(y=0.0010, color='b', linestyle='-')

plt.scatter(range(len(up_down_series)),up_down_series, marker='o', c='r')

plt.axhline(y=-0.0010, color='b', linestyle='-')

plt.show()

It seems that our indicator cannot identify a trend! the change in the price can be in any direction, and most of the time, the price does not change as much as we expected! You might get better results if started with some indicators that have been developed to identify the trends.

Train-Test split

Now, it is time to prepare our data for a classification learning method. Since I altered the problem to a classification, and do not deal with a time series anymore, I can use the Sklear train-test-split function.

train_df, test_df = train_test_split(ctgorized_df, test_size=0.2, random_state=42)

train_df['market-type'].value_counts()

UpTrend-NoTrend 1806

DownTrend-NoTrend 1797

DownTrend-PriceUp 189

UpTrend_PriceUp 182

UpTrend-PriceDown 179

DownTrend-PriceDown 154

Name: market-type, dtype: int64

test_df['market-type'].value_counts()

DownTrend-NoTrend 458

UpTrend-NoTrend 431

UpTrend_PriceUp 56

DownTrend-PriceDown 54

DownTrend-PriceUp 39

UpTrend-PriceDown 39

Name: market-type, dtype: int64

Preprocessing the data

train_df.columns

Index(['open', 'high', 'low', 'close', 'open_lag1', 'high_lag1', 'low_lag1',

'close_lag1', 'open_lag2', 'high_lag2', 'low_lag2', 'close_lag2',

'open_lag3', 'high_lag3', 'low_lag3', 'close_lag3', 'open_lag4',

'high_lag4', 'low_lag4', 'close_lag4', 'open_lag5', 'high_lag5',

'low_lag5', 'close_lag5', 'open_lag6', 'high_lag6', 'low_lag6',

'close_lag6', 'sma20', 'sma50', 'sma100', 'trade_hour',

'dis_to_max_12bar', 'dis_to_min_12bar', 'market-type'],

dtype='object')

numeric_features = ['open', 'high', 'low', 'close', 'open_lag1', 'high_lag1', 'low_lag1',

'close_lag1', 'open_lag2', 'high_lag2', 'low_lag2', 'close_lag2',

'open_lag3', 'high_lag3', 'low_lag3', 'close_lag3', 'open_lag4',

'high_lag4', 'low_lag4', 'close_lag4', 'open_lag5', 'high_lag5',

'low_lag5', 'close_lag5', 'open_lag6', 'high_lag6', 'low_lag6',

'close_lag6', 'sma20', 'sma50', 'sma100',

'dis_to_max_12bar', 'dis_to_min_12bar', ]

ordinal_features = ['trade_hour']

drop_features = ['market-type']

numeric_transform = make_pipeline(StandardScaler())

preprocessor = make_column_transformer(

(numeric_transform, numeric_features),

('passthrough', ordinal_features),

('drop', drop_features)

)

preprocessor.fit(train_df)

new_clomuns = numeric_features + ordinal_features

X_train = pd.DataFrame(preprocessor.transform(train_df), index=train_df.index, columns=new_clomuns)

X_test = pd.DataFrame(preprocessor.transform(test_df), index=test_df.index, columns=new_clomuns)

y_train = train_df['market-type']

y_test = test_df['market-type']

print(X_train.shape, X_test.shape, y_train.shape, y_test.shape)

(4307, 34) (1077, 34) (4307,) (1077,)

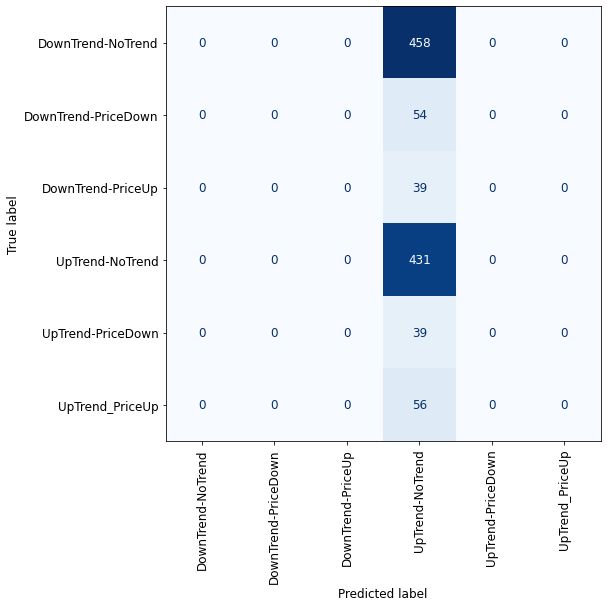

Classification

Due to class imbalance, cross-validation is not a good criterion to validate our model. To have a good understanding of how our classes are classified, I use the Confusion matrix.

from sklearn.metrics import ConfusionMatrixDisplay

def plot_confusion_matrix_classifier(clf):

plt.rc('font', size=12)

disp = ConfusionMatrixDisplay.from_estimator(

clf,

X_test,

y_test,

display_labels=dummy.classes_,

values_format="d",

cmap=plt.cm.Blues,

colorbar=False,

)

plt.xticks(rotation = 90)

fig = disp.ax_.get_figure()

fig.set_figwidth(8)

fig.set_figheight(8)

Dummy Classifier

from sklearn.dummy import DummyClassifier

dummy = DummyClassifier()

dummy.fit(X_train, y_train)

pd.DataFrame(cross_validate(dummy, X_train, y_train, return_train_score=True)).mean()

fit_time 0.003735

score_time 0.001221

test_score 0.419318

train_score 0.419317

dtype: float64

plot_confusion_matrix_classifier(dummy) #plotting the confusion matrix for X_test and y_test

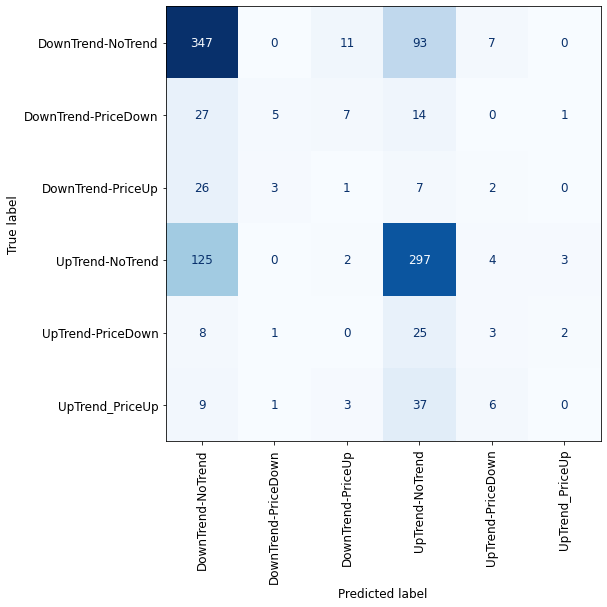

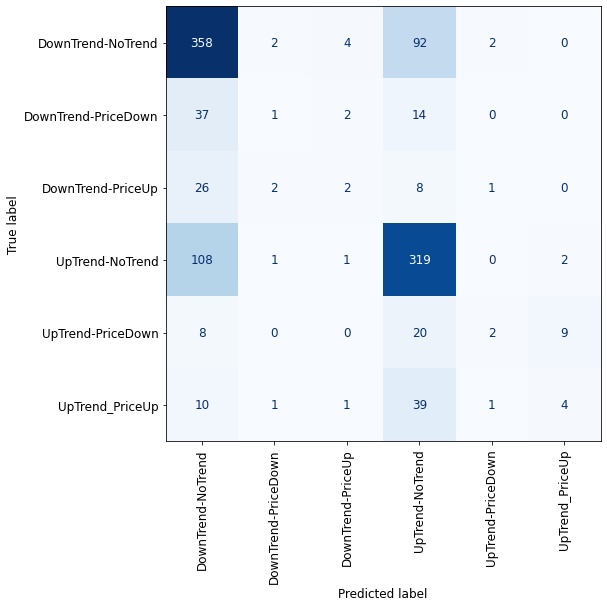

RandomForest

from sklearn.ensemble import RandomForestClassifier

rfc = RandomForestClassifier(max_depth=10, random_state=0)

rfc.fit(X_train, y_train)

pd.DataFrame(cross_validate(rfc, X_train, y_train, return_train_score=True)).mean()

fit_time 1.382421

score_time 0.031423

test_score 0.621547

train_score 0.740597

dtype: float64

plot_confusion_matrix_classifier(rfc) #plotting the confusion matrix for X_test and y_test

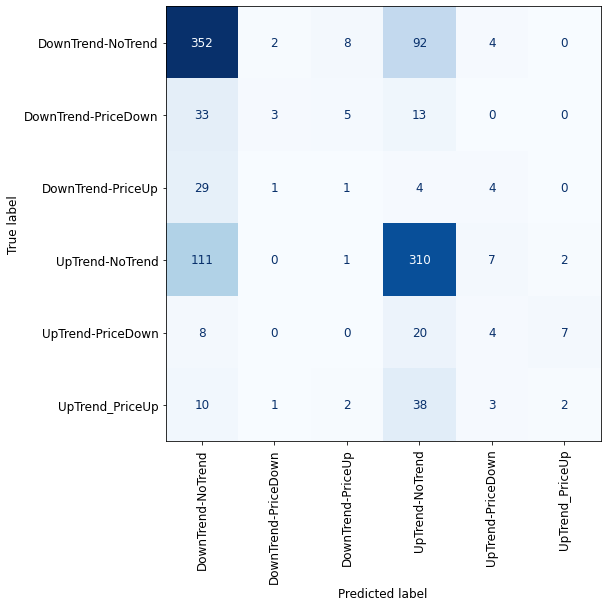

AdaBoost

from sklearn.ensemble import AdaBoostClassifier

adaboost = AdaBoostClassifier(n_estimators=100)

adaboost.fit(X_train, y_train)

pd.DataFrame(cross_validate(adaboost, X_train, y_train, return_train_score=True)).mean()

fit_time 2.602302

score_time 0.058126

test_score 0.573941

train_score 0.594499

dtype: float64

plot_confusion_matrix_classifier(adaboost) #plotting the confusion matrix for X_test and y_test

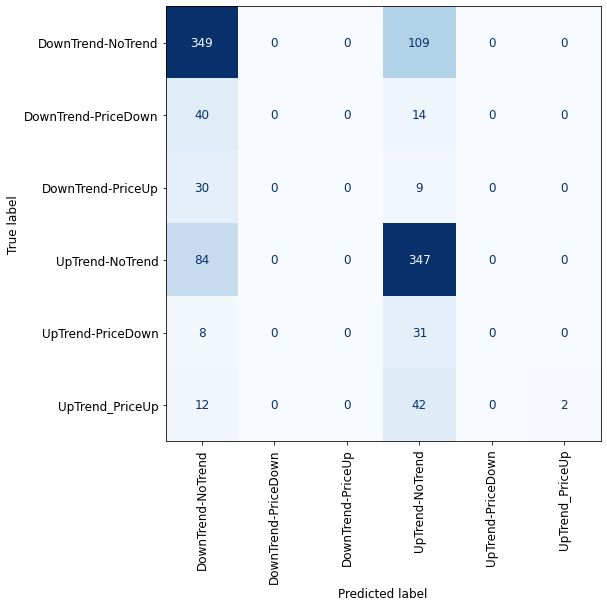

Gradient Boosted Decision Trees

from sklearn.utils import class_weight

from sklearn.ensemble import HistGradientBoostingClassifier

hgbc = HistGradientBoostingClassifier(max_iter=100)

hgbc.fit(X_train, y_train)

pd.DataFrame(cross_validate(hgbc, X_train, y_train, return_train_score=True)).mean()

fit_time 4.151003

score_time 0.069076

test_score 0.601578

train_score 0.973763

dtype: float64

plot_confusion_matrix_classifier(hgbc) #plotting the confusion matrix for X_test and y_test

One-vs-All

from sklearn.multiclass import OneVsRestClassifier

ova_adaboost = OneVsRestClassifier(AdaBoostClassifier(n_estimators=100))

ova_adaboost.fit(X_train, y_train)

pd.DataFrame(cross_validate(ova_adaboost, X_train, y_train, return_train_score=True)).mean()

fit_time 11.210396

score_time 0.216500

test_score 0.624567

train_score 0.665022

dtype: float64

plot_confusion_matrix_classifier(ova_adaboost) #plotting the confusion matrix for X_test and y_test

One-vs-One

from sklearn.multiclass import OneVsOneClassifier

ovo_adaboost = OneVsOneClassifier(AdaBoostClassifier(n_estimators=100))

ovo_adaboost.fit(X_train, y_train)

pd.DataFrame(cross_validate(ovo_adaboost, X_train, y_train, return_train_score=True)).mean()

fit_time 10.252223

score_time 1.013752

test_score 0.616438

train_score 0.676921

dtype: float64

plot_confusion_matrix_classifier(ovo_adaboost) #plotting the confusion matrix for X_test and y_test

Support Vector Machine

from sklearn.svm import SVC

svc = SVC(kernel='rbf', probability=True)

svc.fit(X_train, y_train)

pd.DataFrame(cross_validate(svc, X_train, y_train, return_train_score=True)).mean()

fit_time 4.656176

score_time 0.231267

test_score 0.620849

train_score 0.625493

dtype: float64

plot_confusion_matrix_classifier(svc) #plotting the confusion matrix for X_test and y_test

Due to the imbalanced classes, we cannot validate properly the performance of our models, but by looking at the confusion matrixes we can definitely say that all of the classification methods failed here! For sure, having imbalanced classes affected the results, but the nature of the financial market also plays a significant role, especially in the short time frames (5 minutes here) where price has lots of fluctuations.

In the next blog post, I’ll explain how we can deal with the imbalanced classes.